ad valorem tax florida ballot

Impact fees and user charges. Low-Income Seniors Who Maintain Long-Term Residency on Property.

Thunderbirds Blue Angels Nail Down Year S Florida Stops Blue Angels Florida Air Show

The Municipal and County Ad valorem Tax Cap did not appear on the November 4 2008 statewide ballot in Florida as an initiated constitutional.

. Sales tax Main article. Raises minimum wage to 1000 per hour effective September 30th 2021Each September 30th thereafter. Providing for limiting increases in homestead property valuations for ad valorem tax purposes to a maximum of 3 annually and.

Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or. 3 the stakes are high for Floridians. This is the last of six on this years ballot and its full name is.

Raising Floridas Minimum Wage What it says. The 2021 Florida Statutes. The 2021 Florida Statutes.

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have. From raising the minimum hourly wage to tax discounts for spouses of certain deceased veterans on Nov.

Florida Ballot Measure - Constitutional Amendment 2. 1 AD VALOREM TAXES. In December 1999 the question of whether the city commission should be granted the authority to grant exemptions from city ad valorem taxes pursuant to Article VII section 3 Florida.

The Florida Property Tax Exemption for Veterans Amendment also known as Amendment 7 was a legislatively referred constitutional amendment on the November 7 2006. An ad valorem tax levied. A lien against property.

Heres what you need to know. This question authorized the. Florida Department of Revenue.

2 2010 General Outcome. An Alachua County Ad Valorem Tax Renewal question is on the November 6 2012 election ballot in Alachua County which is in Florida where it was approved. An ad valorem tax which is Latin for according to value is any tax imposed on the basis of the monetary value of the taxed item.

An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and. Property Tax Oversight Program. 1 MILLAGE AUTHORIZED NOT TO EXCEED 2 YEARS.

Ad Valorem Tax Discount for Spouses of Certain Deceased Veterans Who Had Permanent Combat-Related. 5 External links. Equal to Assessed Value.

Housing and Property Military Personnel Constitution. The sovereign right of local. An elected board may levy and assess ad valorem.

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure. Based on the assessed value of property. Below is the ballot summary that appeared on the ballot.

21812 Appropriations to offset reductions in ad valorem tax revenue in. Sales tax Sales tax is one of the. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant.

101173 District millage elections. The district school board pursuant to resolution. Ad valorem ie according to value taxes are.

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of all.

Local Tax Referendum Ballot Bill Advances With Timing Solution Expected

Jacksonville School Tax Referendum Moves One Step Closer To Ballot

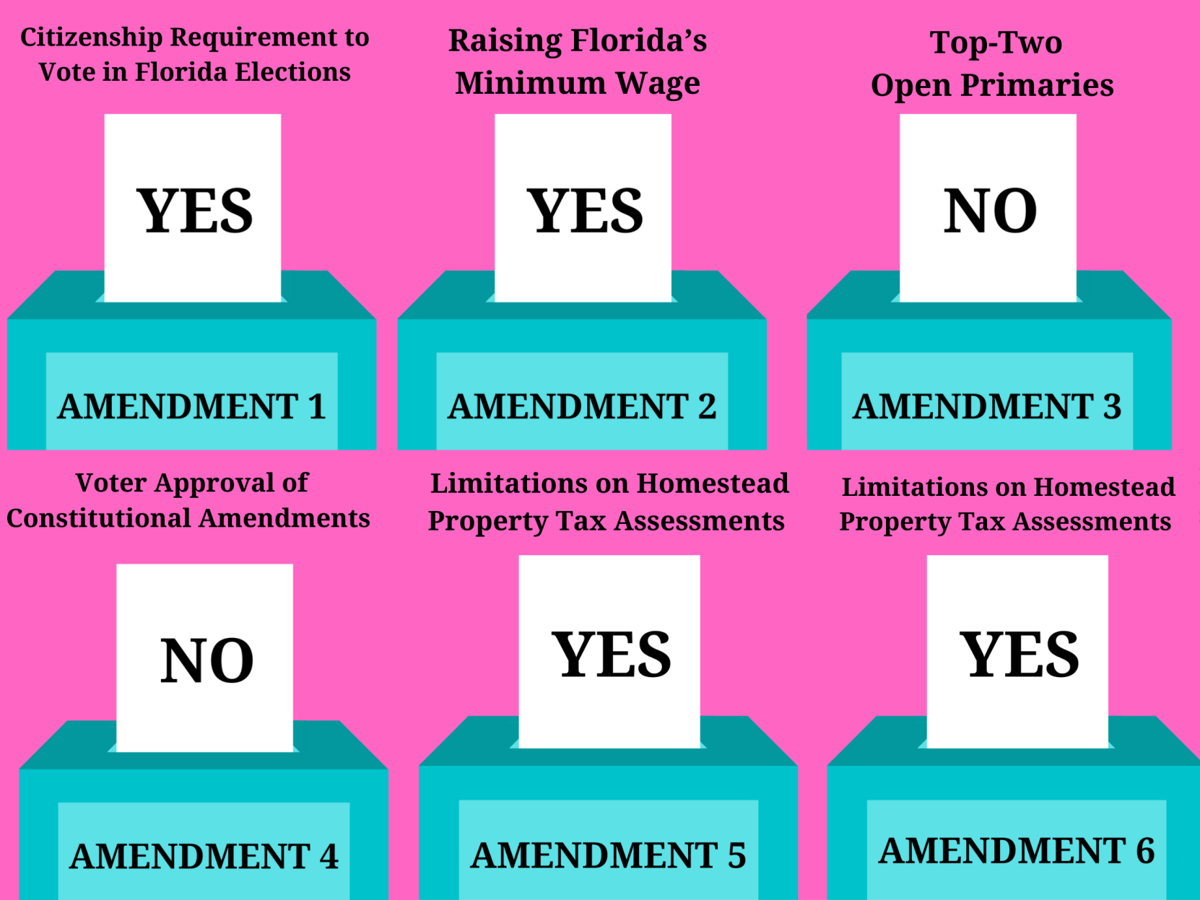

4 Florida Amendments Pass 2 Do Not News Theonlinecurrent Com

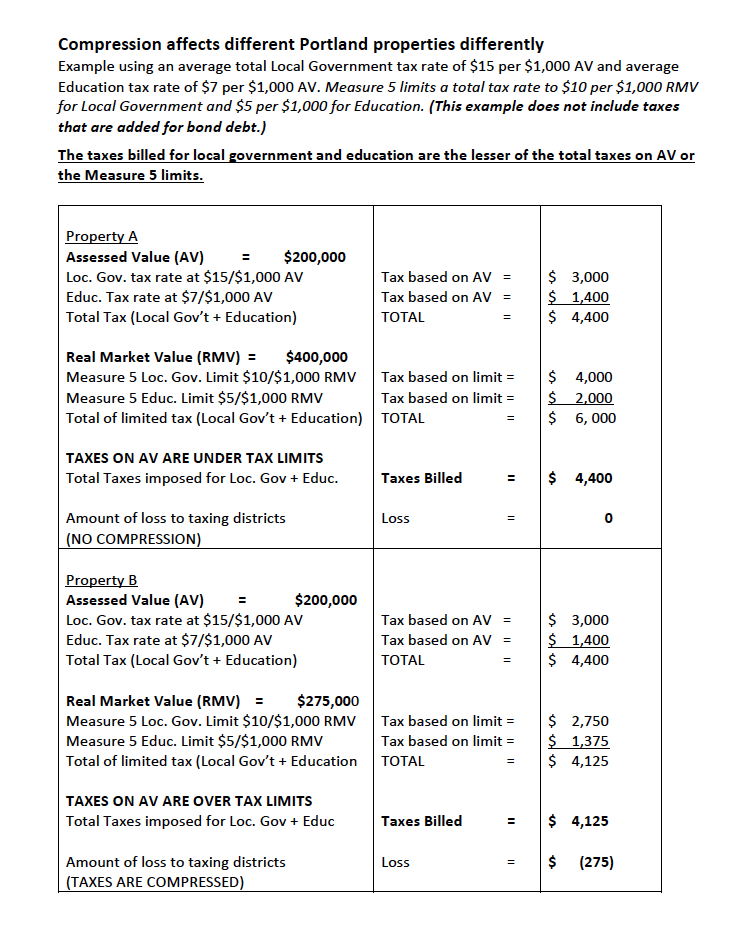

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

Half Cent Sales Tax Manatee County

How Freelancers And Contractors Can Remain Independent With Ab5 Business Insider Technology News Today Workers Rights Big Battle

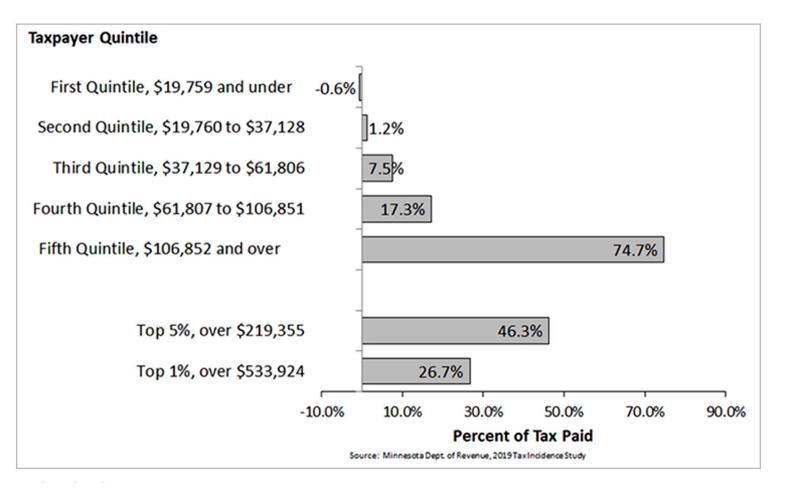

Is Minnesota S Tax System Unfair State Southernminn Com

Florida S State And Local Taxes Rank 48th For Fairness

Florida Voters Approve Amendment 4 10 Others Wusf Public Media

Florida Voters Approve Two Property Tax Related Constitutional Amendments Dean Mead

Despite Skepticism Property Tax Exemption Moves One Step Closer To Becoming Law The Capitolist

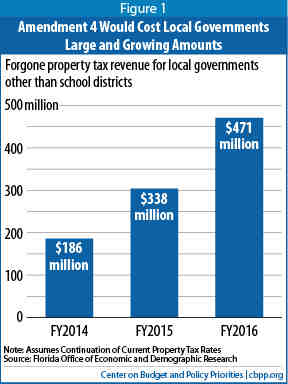

Florida S Amendment 4 Would Cause Tax Rate Increases And Deep Local Service Cuts Likely Harming The State S Economy Center On Budget And Policy Priorities

Aagla Joins The Coalition To Repeal The Death Tax Aagla

Florida Ok S Property Tax Breaks Following Surfside Collapse

Florida To Vote In November On Additional Property Tax Exemption For Certain Public Service Workers Ballotpedia News

Sales Tax Increase On The Ballot The Highlander Highlands North Carolina

Understanding Your Vote Naples Florida Weekly

Lawsuit Challenges Pension Tax Referendum Ballot Language Wjct News