vanguard high yield tax exempt fund state tax information

Tax information for Vanguard funds What youll need to plan for your taxes March 2022 supplemental distribution estimates Any taxable income andor realized capital gains that were greater than the amounts distributed in December 2021 will be distributed in March 2022 as supplemental income dividends or capital gains distributions. By sector negative selection in hospital revenue and tax revenue bonds detracted from performance.

How Do I Determine The Exempt Interest Dividends From Multiple States In A High Yield Tax Exempt Vanguard Fund

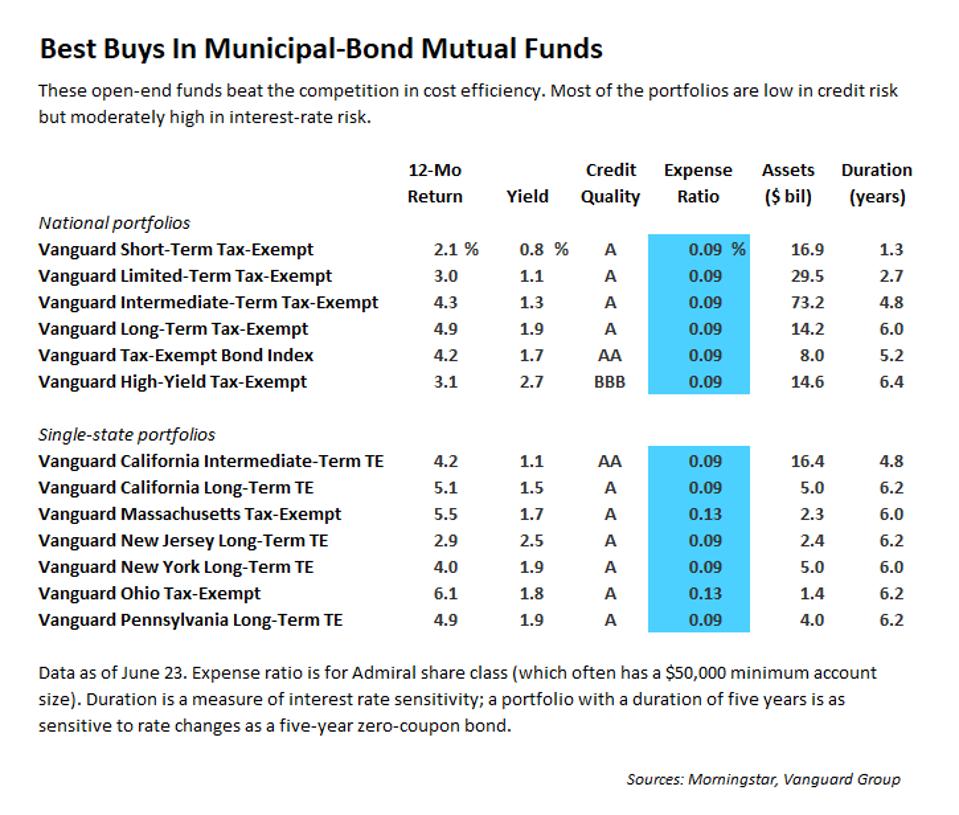

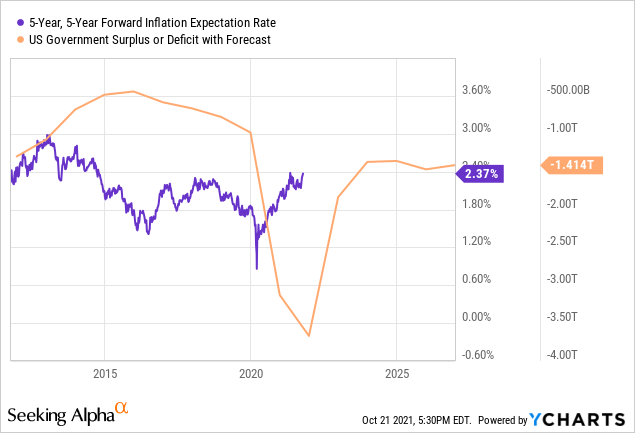

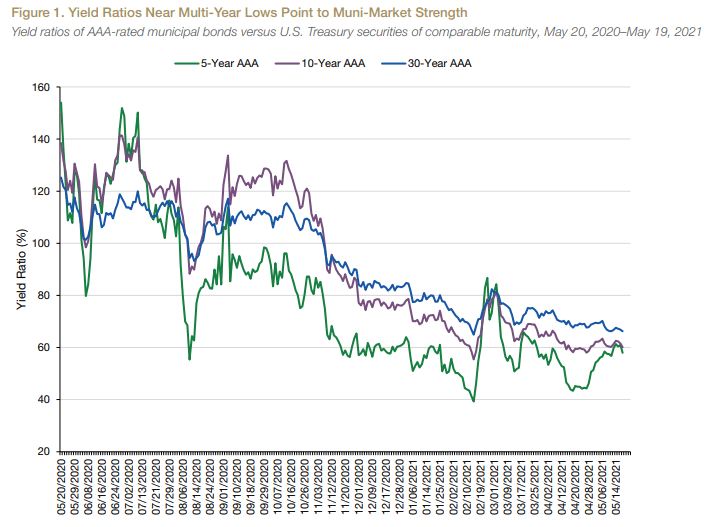

With a AAA Muni yieldTreasury ratio of 97 at 30 years tax-exempt debt is particularly attractive in the long end of the yield curve.

. The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal. The fund focuses on providing higher levels of income. On the reverse side youll find the percentage that was earned in each state or US.

A standard yield calculation developed by the Securities and Exchange Commission for bond funds. Breaking News Get Actionable Insights with InvestingPro. Vanguard high yield tax exempt fund state tax information Wednesday June 15 2022 Edit.

Call us at 877-662-7447 Monday through Friday from 8 am. Home exempt high vanguard yield. For more information please contact Vanguard Financial Advisor Services at 800-997-2798 Monday through Friday from 830 am.

Risk level Low High Total net assets Expense ratio. Vanguard High-Yield Tax-Exempt VWAHX Morningstar Analyst Rating Analyst rating as of Mar 11 2022 Quote Chart Fund Analysis Performance Sustainability Risk Price Portfolio People Parent NAV 1-Day. Depending on an investors state and federal income tax brackets and the particular investment the investors tax-equivalent municipal yield may be higher than 5.

Important tax information for 2021 This tax update provides information to help you report earnings by state from any of your Vanguard municipal bond funds and Vanguard Tax. Although our representatives are qualified to provide information about Vanguard investment products and services they cannot provide tax advice. A portion of these dividends may be exempt from state andor local tax depending on where you file your return.

State and local tax treatment. Find an in-depth profile of Vanguard High-yield Tax-exempt Fund Admiral Shares including a general overview of the business top executives total assets and contact information. Find an in-depth profile of Vanguard High-yield Tax-exempt Fund including a general overview of the business top executives total assets and contact information.

The tax-exempt interest dividends are 100 exempt from federal income tax. For investors in higher-tax states like California and New York. For additional financial information on Vanguard Marketing Corporation see its Statement of Financial Condition.

The Fund invests at. Find an in-depth profile of Vanguard High-yield Tax-exempt Fund including a general overview of the business top executives total assets and contact information. To 7 pm Eastern time.

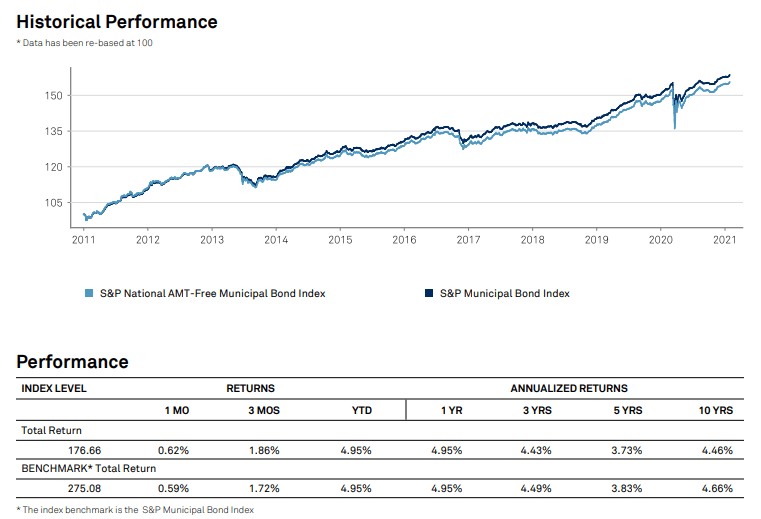

Start 7 Day FREE Trial Register here. Note that tax-exempt income from a state-specific municipal bond fund may be subject to state-imposed alternative minimum tax requirements depending on the state tax laws that apply to you. The Vanguard Tax-Exempt Bond ETF seeks to track the performance of the SP National AMT-Free Municipal Bond Index.

The investment seeks a high and sustainable level of current income that is exempt from federal personal income taxes. Brokerage assets are held by Vanguard Brokerage Services a division of Vanguard Marketing Corporation member FINRA and SIPC. The fund invests at least 80 of its assets in investment-grade municipal.

Get information about the top portfolio holding of the Vanguard High-Yield Tax-Exempt Adm VWALX fund - including stock holdings annual turnover top. Get information about the top portfolio holding of the Vanguard High-Yield Tax-Exempt VWAHX fund - including stock holdings annual turnover top 10 holdings sector and asset allocation. Vwahx Vanguard High Yield Tax Exempt Fund Investor Shares Vanguard Investing Money Mutuals Funds Vanguard Pin On Money Investing Simply Safe Dividends Safe Growing Income For Retirement Dividend Investing Investing.

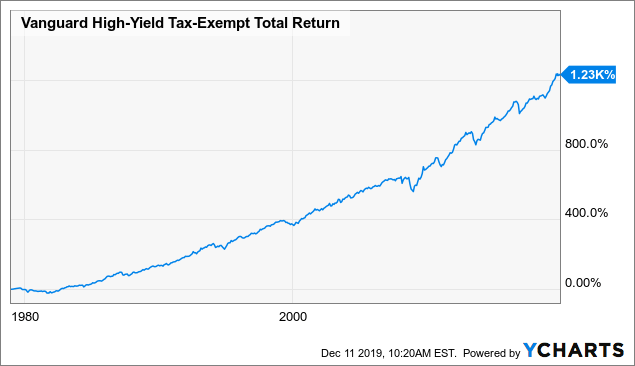

Vanguard High-Yield Tax-Exempt Fund since 7162010 Vanguard Long-Term Tax-Exempt Adm since 7162010 Vanguard High-Yield Tax-Exempt Fund Admiral Shares since 7162010 Portfolio Data More 30-Day Yield 4 359 7312022 Duration 762 Years 6302022 Fund Overview. The yield is calculated by dividing the net investment income per share earned during the 30-day period by the maximum offering price per share on the last day of the period. To 8 pm Eastern time.

Listed on NYSE Arca. Reported on Form 1099-DIV Box 11 is 100 exempt from California state income tax. Vanguard High-Yield Tax-Exempt Fund Fund VWAHX 1076 000 000 08152022 1200 AM NAV Add to watchlist Asset Allocation Top Instruments Bond Cash 983 Asset Allocation Top Countries Guam Unit.

For the quarter Vanguard High-Yield Tax-Exempt Fund underperformed its benchmark index the Bloomberg Municipal Bond Index 294 and the average return of its peers 422. The yield figure reflects the dividends and interest earned during the 30-day period after the.

7 Charts On Where Investors Are Putting Their Money In 2022 Morningstar

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vpaix Vanguard Pennsylvania Long Term Tax Exempt Fund Investor Shares Vanguard Advisors

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

How Do I Determine The Exempt Interest Dividends From Multiple States In A High Yield Tax Exempt Vanguard Fund

Vwahx Vanguard High Yield Tax Exempt Fund Class Info Zacks Com

Vanguard High Yield Tax Exempt Don T Call It Junk Kiplinger

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vteax Vanguard Tax Exempt Bond Index Fund Admiral Shares Ownership In Us419792nr32 Hawaii St Go Ser 11 Dz16 Preref 5 0 12 01 27 21 13f 13d 13g Filings Fintel Io

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vwahx Vanguard High Yield Tax Exempt Fund Investor Shares Vanguard Investing Money Mutuals Funds Vanguard

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha